TRAINING & RESOURCES

for self-employed individuals and small business owners

COMMUNITY

for DIY bookkeeping and Making Tax Digital quarterly update support

SIGN UP FOR FREE

for bookkeeping tips, software demos and product news

About Springreach Training & Coaching

Jill Blofield FMAAT – Bookkeeping, Self Assessment and Making Tax Digital for Income Tax trainer.

Resources and support for UK self-employed individuals and small businesses.

Training & Resources

Top quality training and resources, clearly presented and explained, on topics of interest to self-employed individuals and small business owners. Monthly online bookkeeping support and accountability sessions.

FIND OUT MORE

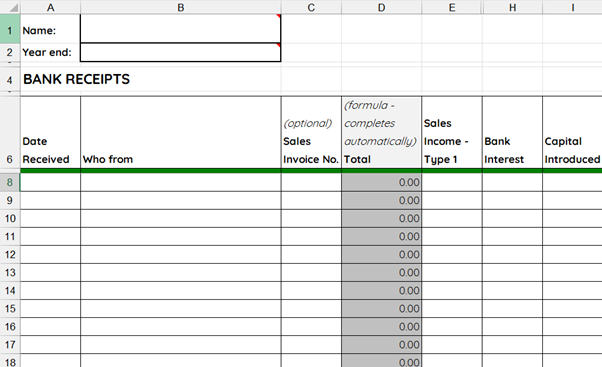

Self-Employed Bookkeeping for Beginners

A step-by-step beginners’ guide to self-employed bookkeeping. This online course outlines an 8-step process to keeping good bookkeeping records, delivered through a combination of practical demonstrations, videos, templates and checklists.

Join the Springreach DIY Bookkeeping Community

A membership for self-employed individuals and small business owners. Membership includes a monthly online bookkeeping Q&A support and accountability session, masterclasses, templates, checklists, software demos and support with a range of software packages.

Sign up to our mailing list

Latest from Blog

For self-employed individuals, entrepreneurs, small business owners and bookkeepers – blogs on business and accounting matters, topical tax tips, and personal and professional development.

What’s all the fuss about Making Tax Digital?

It all depends on where you’re starting from, and whether you use more than one software package to handle your business record-keeping. If your business is straightforward, Making Tax Digital[…]

Read moreHow to use spreadsheets for Making Tax Digital

Despite the advantages of using software, what if you’re happy using spreadsheets for your bookkeeping and don’t want to change? In this blog, I explore a free bridging software solution[…]

Read moreCan I still use spreadsheets to keep my bookkeeping records?

The short answer is – yes, you can – but here are some factors to consider: Which tax system are you in? If you’re in Self Assessment, spreadsheets are absolutely[…]

Read more“Clients should never be allowed near their own bookkeeping!”

I disagree. If you run your own business, it should be your choice who does your bookkeeping. Doing it yourself might be the right decision for you, it might not[…]

Read more